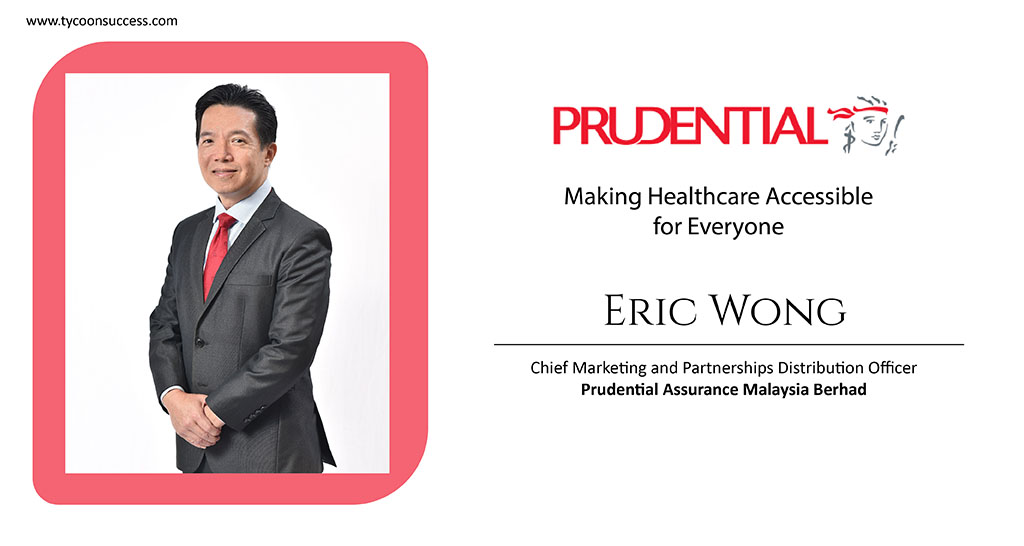

Meet Eric Wong, the Chief Marketing and Partnerships Distribution Officer of Prudential Assurance Malaysia Berhad (PAMB), a Malaysia-based leading and innovative insurance company, serving the savings, protection, and investment needs of Malaysians by offering a full range of financial solutions through its branches, agency force, and bancassurance distribution partners network across Malaysia.

Prudential’s purpose is to help people to get most out of their lives by making healthcare affordable and accessible, protecting people’s wealth, growing their assets, and empowering them to save for their goals. Founded in 1924, the organization has been around for nearly a century and is looking forward to being around for many more years to provide value for its customers- as a relevant, accessible, and inclusive insurance protection to all Malaysians. Prudential takes pride in itself as the most trusted life partner for health and protection solutions, the two key pillars that help its clients to live confidently.

With Malaysia facing 12% medical inflation, Prudential is actively educating Malaysians on the importance of medical and critical illness protection. In order to help Malaysians navigate through this, Prudential provides the best medical coverage that grows with the customer to ensure they get adequate protection throughout their lives. The organization also rewards its clients who have a claim-free year with a no claim benefit feature.

The Steadfast Leader

Eric completed his graduation from University Malaya with a major in Accounting. He started his career with a global FMCG brand, where he had the opportunity to hold both local and regional senior roles, covering the APAC market. Later in 2011, he moved into banking and started working with one of the world’s premier consumer banks.

Presently, as the Chief Marketing & Partnerships Distribution Officer for Prudential in Malaysia, Eric is responsible for the equity of the Prudential brand, ensuring in-depth understanding of our customers by delivering best in class products and services in various customer segments and driving the bancassurance business in Malaysia, in partnership with UOB and Standard Charted Bank in Malaysia.

A Customer-Centric Organization

“If I had to list my greatest accomplishments in Prudential, it would be how we truly understand our customers and use this insight to design our solutions and services that are centered on their needs,” Eric explained. “This purpose, to help people get the most out of life, also drives our CSR commitment to ensure underserved families and children can achieve financial resilience and peace of mind.”

- Understanding Customers and Delivering on their Needs: As a forward-thinking company, Prudential knows that technology is the future and launched its AI-powered health and financial well-being app- Pulse by Prudential, in 2019. This app is crucial to Prudential’s multi-channel strategy to make healthcare more accessible and increase financial inclusion. It provides users access to services like health check, online doctor consultation to help them better manage their health needs, and digital wealth tools to make financial decisions simpler.

- Products and Solutions Designed Around Customer Needs and Interests: Financial protection is not a top priority for most in Malaysia. Young Malaysians between 25-34 are least covered for health emergencies or the death of a partner, as they claim insurance is difficult to understand. This prompted Prudential to find compelling ways that resonate with young Malaysians on the need for financial protection. It eventually led to the launch of Prudential’s first standalone critical illness solution, PRUMy Critical Care, through which the organization wanted to raise the fact that critical illness protection is becoming more prevalent, and starting your journey on CI protection when young is essential. It deep-dived into specific challenges that young Malaysians were facing, their needs and wants from critical illness protection, and ways to articulate the content, which sparked their curiosity to find out more. It eventually prompted Prudential to take a bold step and collaborate with local influencers, who are also cancer survivors, to share their stories light-heartedly. This message instantly captured the young generation’s attention, as they could relate to the influencers, who they view as everyday people just like them.

- Building Financial Resilience for Underserved Families and Children: Prudential also takes pride in its community investment to help Malaysians Building Financial Resilience for Underserved Families and Children: Prudential also takes pride in its community investment to help Malaysians.

Putting Customers at Heart

Prudential’s solutions and offerings are designed to keep customers’ best interests in mind. It is one of the first insurers to offer protection from 14 gestational weeks to medical solutions with auto increasing annual limit and a critical illness plan that covers mental health.

“We are one of the first insurers who launched a Total Pandemic Protection plan, so customers had enhanced protection during the pandemic. Today, customers will automatically enjoy Total Pandemic Protection when they sign up for any medical plans so they can live confidently during turbulent times,”- Eric said. “We recently launched a comprehensive 5-in-1 protection plan – PRUFirst that is tailored to Gen Zs who seek simple and easy-to-understand solutions. This solution provides Medical, Accident, Life/ Total Permanent Disability (TPD), and Payor benefits to protect Gen Zs against the financial impact of unexpected life events.”

Beyond providing the best-in-class protection plan, Prudential also started its digital transformation journey several years ago. When the pandemic first hit the country, it immediately pivoted its services to digital platforms to stay operational with minimal disruption. This includes facilities like e-claims, e-endorsements, and e-submissions. Additionally, the organization has launched the NextGen Underwriting Engine to perform a real-time risk assessment to shorten the policy application processing time. It constantly engages with its dedicated and committed agents, who are at the forefront as they continuously engage with current and potential customers.

Increasing Awareness

Eric believes although the awareness regarding the importance of insurance is rising, the take-up rate has remained the same for the last five years. As a member of the industry, Prudential will play an active role in educating its audience and developing more solutions and offerings in line with the market needs to protect more Malaysians.

It also intends to empower Malaysians with the knowledge to make informed financial decisions. In order to achieve that, Prudential has made concerted efforts to increase financial literacy through its financial education programs that start with children and are extended to youth and adults from underprivileged communities.

Looking at the Future

“By living our purpose of helping people get the most out of life – we remain steadfast in our commitment to making healthcare affordable, protecting our customer’s wealth, and growing their assets.”- Eric said.

In the future, Prudential will continue to provide the best health and protection solutions to meet its customers’ changing needs and to offer seamless customer experience through its new digital capabilities.